Compliance risk assessment template

What if you could build a compliance risk assessment to analyze and advise in any domain, accurately and objectively?

Effective compliance risk assessments give you and your business the peace of mind you deserve.

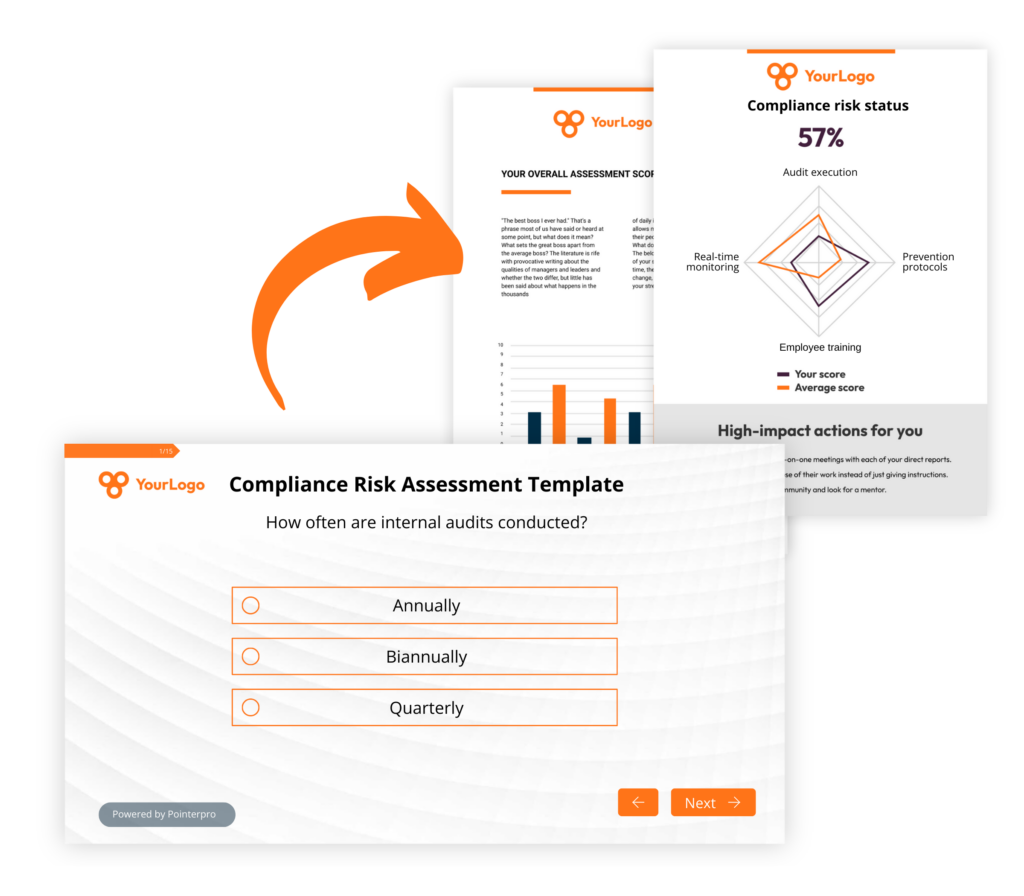

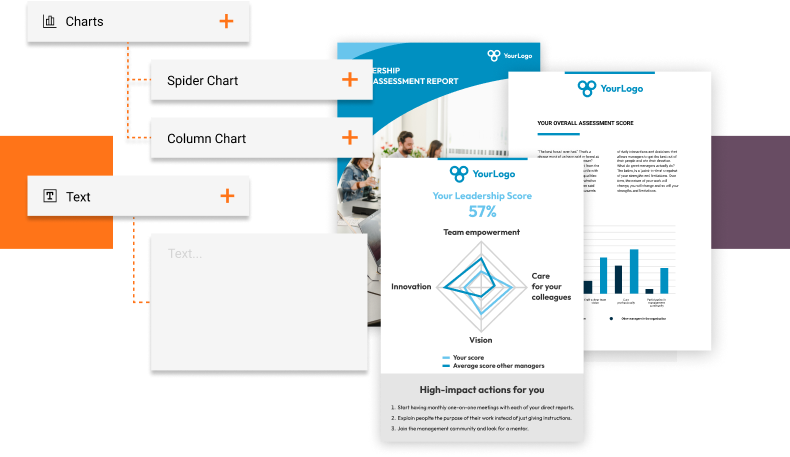

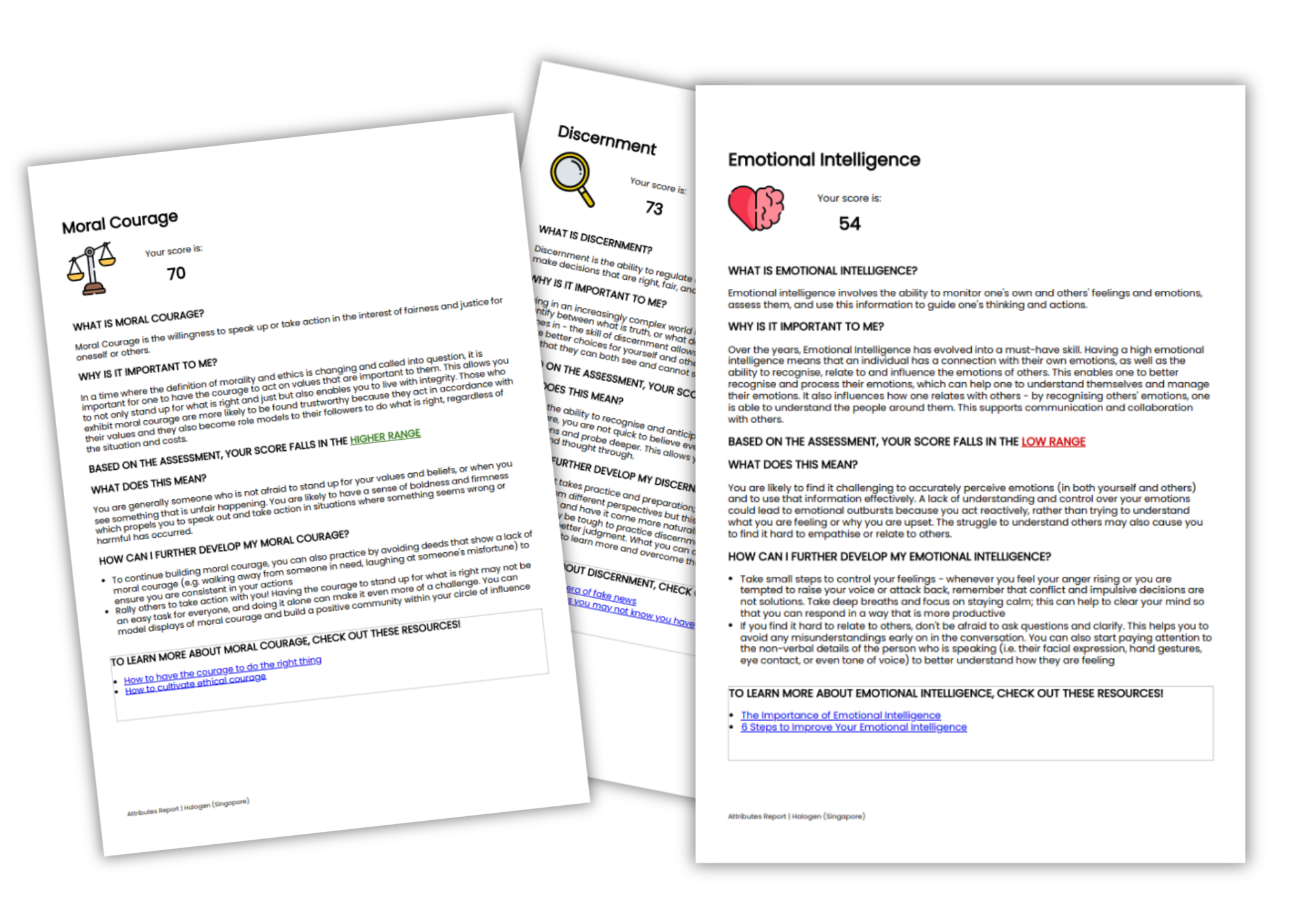

Pointerpro is the 2-in-1 software that combines assessment building with personalized PDF report generation.

Compliance risk and how to assess it accurately

Compliance risk refers to the potential for an organization to violate laws, regulations, or industry standards, resulting in legal penalties, financial losses, and damage to reputation. Navigating this complex landscape requires a proactive approach to identify, assess, and mitigate compliance risks effectively.

Accurate assessment is the cornerstone of effective compliance risk management. On this page, we’ll walk you through some of the key elements of a compliance risk assessment template. To start, here are 12 actionable tips to follow in chronological order:

- Define objectives and scope: Clearly articulate the goals of the assessment and identify the specific compliance areas or regulations to be addressed.

- Engage stakeholders: Involve key stakeholders, such as legal experts, compliance officers, and department heads, in the questionnaire development to ensure comprehensive coverage.

- Select relevant compliance areas: Tailor the questionnaire to address the most pertinent compliance areas based on your industry, organizational size, and regulatory landscape.

- Prioritize risks: Prioritize compliance risks based on potential impact and likelihood. This helps in focusing resources on high-priority areas.

- Develop clear and concise questions: Formulate questions that are easy to understand, specific, and directly related to compliance requirements.

- Include legal and regulatory requirements: Ensure the questionnaire includes questions directly aligned with relevant legal and regulatory requirements.

- Incorporate industry best practices: Integrate questions that assess adherence to industry-specific best practices, standards, and benchmarks.

- Consider technology and data security: Technology is more impactful than ever on compliance. If applicable, include questions related to technology and data security compliance, especially in industries handling sensitive information.

- Provide clear response options: Offer clear and concise response options, such as multiple-choice or Likert scale, to facilitate accurate and consistent responses.

- Include open-ended questions: Supplement closed-ended questions with open-ended ones to encourage additional insights and comments from respondents.

- Pilot test the questionnaire: Conduct a pilot test with a small group to identify any ambiguities, issues with question clarity, or gaps in coverage.

- Develop recommendations: Design the questionnaire to generate actionable tips and insights for different stakeholders based on the response data.

3 reasons to use Pointerpro as a compliance risk assessment tool

3 reasons to use Pointerpro as a compliance risk assessment tool

Interactive user experience

With the Questionnaire Builder you get to create an engaging assessment. How? With numerous design and layout options, useful widgets and countless question types.

Refined, score-based analysis

Our custom scoring engine helps you quantify the compliance risk levels in any domain. The result? An objective and nuanced assessment of your respondents’ situation.

Automated feedback in PDF

Thanks to your setup in the Report Builder, respondents instantly get a detailed PDF report with helpful charts, a personalized analysis of compliance risks, and tips.

1.500+ businesses worldwide build assessments with Pointerpro

No more incomplete or disjointed solutions

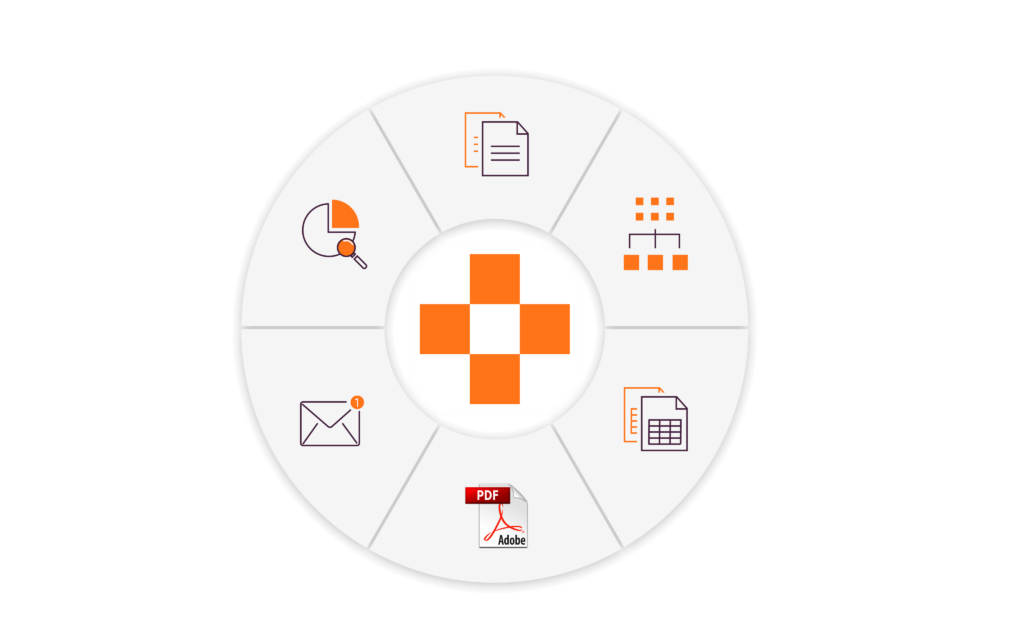

Typically, a complex chain of tools and manual interventions are required to get from data collection and analysis to personalized reporting.

Even when this type of solution works, it’s prone to error and requires regular maintenance. The result? Unanticipated costs and time investments that keep recurring.

Not with Pointerpro!

The only complete assessment solution

Pointerpro streamlines everything you need in a single platform:

- Questionnaire Builder: To build engaging questionnaires and boost response rates

- Report Builder: To create fully branded PDF templates and automate personalized feedback

- Distribution Portal: To delegate and boost assessment distribution

20 compliance risk assessment example questions

Here are 20 of the best compliance risk assessment example questions divided into 2 categories:

- 10 compliance risk assessment questions for banks

- 10 compliance risk assessment questions for healthcare

10 compliance risk assessment questions for banks

- What measures are in place to ensure compliance with anti-money laundering (AML) regulations?

- How does the bank manage and report transactions that may be considered suspicious or unusual?

- What procedures are in place to ensure compliance with Know Your Customer (KYC) requirements?

- How often does the bank conduct internal audits to assess compliance with regulatory standards?

- What steps are taken to ensure compliance with data protection and privacy regulations?

- How does the bank monitor and manage compliance with Basel III capital requirements?

- What protocols are in place to adhere to consumer protection laws and regulations?

- How does the bank ensure compliance with regulations related to fair lending practices?

- What measures are in place to comply with regulations governing electronic funds transfer and online banking security?

- How does the bank stay informed and adapt to changes in financial regulations?

These compliance risk assessment template questions are designed to assess various aspects of compliance risk in the banking sector, covering areas such as anti-money laundering, customer due diligence, internal audits, data protection, capital requirements, consumer protection, fair lending, electronic funds transfer, and staying informed about regulatory changes. The questions aim to gauge the bank’s adherence to relevant regulations and its proactive approach to compliance.

10 compliance risk assessment questions for healthcare

- How does the healthcare facility ensure compliance with the Health Insurance Portability and Accountability Act (HIPAA) regulations?

- What measures are in place to safeguard patient data and maintain confidentiality in accordance with healthcare privacy laws?

- How does the facility manage and report incidents of data breaches or unauthorized access to patient information?

- What procedures are followed to ensure compliance with billing and coding regulations, including accurate documentation of medical services?

- How does the healthcare facility manage compliance with clinical standards and guidelines, such as those set by accrediting bodies or medical associations?

- What protocols are in place to adhere to infection control and prevention regulations, especially in critical care areas?

- How does the facility ensure compliance with regulations related to the safe disposal of medical waste and hazardous materials?

- What measures are taken to comply with regulations governing patient consent, particularly for sensitive procedures or research participation?

- How does the healthcare facility manage compliance with fraud and abuse laws, including the prevention of kickbacks and inappropriate financial relationships?

- What steps are in place to stay updated on changes in healthcare regulations and adapt policies and procedures accordingly?

These compliance risk assessment template questions aim to assess various aspects of compliance risk in healthcare, covering areas such as patient privacy, data security, billing and coding, clinical standards, infection control, waste disposal, and more.

The questions are designed to evaluate the healthcare facility’s adherence to relevant regulations and its proactive approach to compliance in the complex and highly regulated healthcare environment.

Get the full picture on compliance

A lack of compliance to regulations and legislation can be disastrous for an organization. You don’t want to be second guessing.

With our Aggregate Reports feature you consolidate all the data. The result? The auto-generated and full-fledged organization report you need to set things straight.

Use custom scoring in your compliance risk assessment template

A score-based questionnaire is effective for compliance risk assessment. Here are 9 reasons why:

- Quantifiable measurement: Numerical scores offer a measurable representation of compliance levels, allowing for tracking and comparison.

- Objective evaluation: Scoring adds objectivity, reducing subjective interpretations and ensuring consistency.

- Risk prioritization: Scores enable prioritization based on severity, guiding resource allocation to critical areas.

- Clear communication: Numeric scores facilitate concise communication of compliance status to stakeholders.

- Efficient resource allocation: Focus resources on areas with lower scores or higher compliance risks for optimized efforts.

- Enhanced reporting: Score-based assessments support comprehensive reports with graphical representations for effective communication.

- Scalability: Adaptable for organizations of various sizes and complexities, making it a versatile tool.

- Standardized evaluation criteria: A scoring system requires predefined criteria, ensuring consistent and fair evaluations.

- Continuous improvement: Regular assessments with scores create a feedback loop, supporting ongoing improvement efforts.

Never really worked with scored assessments before? It’s quite simple. Our Product Director Bruno introduces you to the concept in the video below:

What Pointerpro clients are saying

Raise your reputation

Thanks to a fully branded design, your risk assessments and auto-personalized risk reports literally bear your hallmark. Time to stand out!

The compliance risk report: Importance and key components

A compliance risk report, following an assessment, is critical for organizations to evaluate and communicate their adherence to relevant laws, regulations, and internal policies. And of course: to take the necessary steps when they’re not compliant.

Especially in business landscapes where regulatory requirements tend to change rapidly, organizations need a comprehensive and dynamic approach to understanding compliance risks. That’s why automated PDF reports you can build with Pointerpro are so uniquely effective.

The compliance risk report serves as a structured document that not only identifies areas of non-compliance but also provides insights into the effectiveness of the organization’s overall compliance program. It is a crucial instrument for senior management, stakeholders, and regulatory bodies to gain a clear understanding of the organization’s commitment to ethical and lawful conduct.

This report plays a pivotal role in shaping strategic decisions. It fosters a culture of accountability. Let’s delve into the key components that constitute an effective compliance risk assessment report template.

- Executive summary: A concise summary of the report, highlighting key findings, trends, and critical issues. This section is often tailored for senior management and stakeholders seeking a quick overview.

- Introduction: An introduction to the purpose and scope of the compliance risk report. This section may include a brief overview of the regulatory landscape impacting the organization.

- Regulatory landscape: A detailed examination of the regulatory environment relevant to the organization. This may include changes in laws, emerging regulations, and updates that could impact compliance.

- Compliance objectives and framework: Clearly defined compliance objectives and the framework used to evaluate to what extent they are achieved. This section can also outlines the organization’s approach to compliance, including policies, procedures, and relevant controls.

- Key performance indicators (KPIs): If there are specific metrics and KPIs the assessment was designed to measure it’s useful to explain them here as well. These KPIs may include data on the number of reported incidents, completion rates for training programs, and other relevant performance indicators.

- Existing remediation efforts: Details on corrective actions that are currently being taken to address identified compliance issues, based on the responses to your assessment. This section outlines the steps taken to remediate non-compliance and prevent similar occurrences in the future.

- Emerging risks and trends: An analysis of emerging compliance risks and trends that may impact the organization in the future. This includes an assessment of industry developments, regulatory changes, and potential areas of heightened risk.

- Recommendations: Actionable tips for enhancing the organization’s compliance posture. This section provides guidance on areas where improvements can be made to strengthen compliance efforts.

- Training and awareness programs: A reference to useful training programs to educate employees on compliance requirements, based on the assessment responses. This should also include details on the frequency of training.

- Conclusion: A concluding section summarizing the overall state of compliance and any key takeaways. This may include a forward-looking perspective on the organization’s compliance strategy.

10 common compliance risk assessment templates

Risks reside in various corners. Compliance can go wrong on many different levels, depending on the industry. That means it’s possible to develop compliance risk assessments tailored to very precise risk domains. Here are a few examples:

- Human error compliance risk assessment template: This template evaluates the potential risks associated with human errors in compliance processes. It assesses the likelihood and impact of errors in policy adherence, data entry, and other critical compliance activities.

- Monitoring effectiveness compliance risk assessment template: Designed to assess the effectiveness of monitoring systems and processes. It examines whether the organization’s monitoring mechanisms are robust enough to detect and respond to compliance issues promptly.

- Improper storage compliance risk assessment template: This template focuses on the risks associated with improper storage of sensitive information, such as customer data, financial records, or intellectual property. It assesses storage protocols and safeguards against unauthorized access.

- Access audit failure compliance risk assessment template: Evaluates the risks related to the failure of access audits. It assesses the adequacy of systems in auditing user access to sensitive information, identifying potential gaps, and ensuring compliance with access control policies.

- Misconfigurations compliance risk assessment template: Assesses the risks associated with misconfigurations in IT systems and applications. This template evaluates the likelihood and impact of configuration errors that may lead to compliance breaches.

- Data encryption compliance risk assessment template: Focuses on evaluating the organization’s compliance with data encryption standards and protocols. It assesses whether sensitive data is appropriately encrypted to meet regulatory requirements.

- Policy adherence compliance risk assessment template: Assesses the level of compliance with internal policies and external regulations. It examines whether employees are consistently following established policies and procedures.

- Third-party compliance risk assessment template: Evaluates the compliance risks associated with third-party relationships. It assesses the effectiveness of due diligence processes, contract terms, and monitoring mechanisms for third-party compliance.

- Regulatory change impact assessment template: Assesses the potential impact of regulatory changes on the organization’s compliance posture. It helps organizations proactively adapt to new regulations and ensure ongoing adherence.

These compliance risk assessment templates can be customized to fit the specific needs and industry requirements of an organization. They provide a structured approach to identifying, assessing, and mitigating compliance risks, promoting a proactive and risk-aware culture within the organization.

Compliance vs risk management

Terms like compliance and risk management are continuously intertwined. However, it’s important to keep their distinction in mind.

Compliance involves ensuring that an organization adheres to the relevant laws, regulations, and standards governing its industry. The primary focus is on legal and regulatory conformance, with the aim of preventing violations and avoiding associated penalties and reputational harm. Compliance efforts are structured to meet specific legal requirements, and organizations typically have dedicated teams or officers responsible for monitoring, enforcing, and reporting on compliance matters. It’s about conforming to external standards to ensure ethical and legal business practices.

On the other hand, risk management is a broader concept. It encompasses the identification, assessment, and mitigation of potential risks that could impact an organization’s objectives. While compliance is a critical component of risk management, the latter extends beyond legal obligations to encompass a more comprehensive approach to identifying and managing various types of risks, including operational, financial, strategic, and reputational risks.

What is governance risk and compliance (GRC)?

Another common term, or actually acronym, that contributes to potential confusion between compliance and risk management: GRC.

GRC stands for Governance, Risk, and Compliance. It designates the integrated approach that organizations use to align their business strategies with governance, manage risks effectively, and ensure compliance with various regulations and standards.

GRC provides a holistic view of how governance, risk management, and compliance activities interrelate. It helps organizations to make informed decisions, prioritize resources effectively, and create a culture of accountability and transparency.

It’s important to note that GRC is not a one-time project but an ongoing process. It involves establishing a feedback loop to continually monitor, assess, and enhance governance structures, risk management processes, and compliance measures based on changing business environments and regulatory landscapes.

Industries where compliance risk assessment is crucial

Depending on the industry you work for, you may wonder: “To assess or not to assess?” Compliance risk is a critical consideration in any domain where your organization must adhere to specific regulations, standards, and legal requirements. Some of the most typical domains where compliance risk is highly relevant include:

- Financial services: Banking, investment, and insurance industries must adhere to financial regulations and standards to ensure fair practices, transparency, and data security.

- Healthcare: Compliance with healthcare regulations such as the Health Insurance Portability and Accountability Act (HIPAA) is essential to protect patient privacy and ensure the secure handling of medical information.

- Information technology and data security: Organizations handling sensitive data, especially in the tech industry, must comply with data protection laws, cybersecurity standards, and privacy regulations.

- Pharmaceuticals and life sciences: Compliance is crucial in research, development, and marketing of pharmaceutical products to ensure safety, efficacy, and ethical standards.

- Environmental compliance: Industries dealing with environmental impacts, such as manufacturing and energy, must comply with environmental regulations to minimize ecological harm.

- Telecommunications: Compliance is vital in telecommunications to ensure fair competition, data protection, and adherence to communication regulations.

- Government contracts and procurement: Organizations working with government contracts must comply with specific regulations governing procurement, bidding, and contract execution.

- Human resources and employment: Compliance in HR includes adherence to labor laws, workplace safety regulations, and anti-discrimination laws to protect employees and ensure fair employment practices.

- Retail and consumer protection: Retailers must comply with consumer protection laws, product safety regulations, and fair trading practices to ensure the safety and satisfaction of consumers.

- Energy and utilities: Compliance is crucial in the energy sector to adhere to environmental regulations, safety standards, and ensure the responsible production and distribution of energy.

- Aerospace and defense: Compliance in this sector involves adherence to export control laws, defense regulations, and quality standards to ensure national security and product safety.

- Education: Educational institutions must comply with regulations related to student privacy, accreditation standards, and financial aid programs.

- Nonprofits and charities: Nonprofit organizations must adhere to regulations governing tax-exempt status, charitable contributions, and transparency in financial reporting.

- Real estate: Compliance is important in real estate for adherence to property laws, zoning regulations, and fair housing standards.

- Legal and professional services: Legal and professional service providers must comply with professional standards, confidentiality regulations, and ethical codes of conduct.

With a comprehensive and holistic compliance risk assessment template, risk managers can, to some extent, work and consult across these different industries. Of course, there are factors that can limit the extent of their versatility. While many risk management principles are transferable, each industry has its unique set of regulations, challenges, and nuances.

Create your compliance risk assessment today

You may also be interested in

Recommended reading

Vlerick Business School digitalizes entrepreneurship development with Pointerpro [case study]

What do a top-tier international business school based in the capital of Europe and Pointerpro have in common? At the

Attain Global: How to do psychometric tests right and build a cutting-edge international business [case study]

In many countries worldwide, the pursuit of skillful and engaged employees is not so much a war on talent as

How youth development specialist Halogen reaches thousands of young Singaporeans with Pointerpro [case study]

Singapore, in Southeast Asia, is a global, economic powerhouse with a population of a little less than 6 million people.