Trusted by 1.500+ consultants, coaches, marketers, HR specialists and companies worldwide

Imagine you’re a daring explorer embarking on a thrilling adventure in a dense jungle. As you gear up for the journey, it’s crucial to consider the potential risks that could arise. This is where risk assessment becomes invaluable.

Like navigating the jungle, running a business involves facing uncertainties and potential hazards. Risk assessment is akin to having a seasoned guide who helps you identify, analyze, and mitigate these risks in the business landscape.

Before diving headfirst into a new venture, you take a moment to assess the market, competitors, and economic conditions. This initial evaluation lets you anticipate potential risks and make informed decisions about your business strategy.

As you delve deeper into the business realm, you remain vigilant for potential pitfalls. These could include changing consumer demands, technological advancements, or regulatory shifts. By acknowledging these risks, you can take appropriate measures to adapt your business model, enhance your offerings, or implement contingency plans.

Moreover, risk assessment promotes preparedness in the business world. Just like in the jungle, having backup plans is essential. You anticipate potential disruptions, such as supply chain issues or financial setbacks, and develop strategies to mitigate their impact. This proactive approach helps you stay resilient and maintain a competitive edge.

Remember, risk assessment isn’t about avoiding risks altogether or stifling innovation. Instead, it empowers you to make calculated decisions, balancing embracing opportunities and managing potential pitfalls. By assessing risks in advance, you can navigate the business landscape with greater confidence and ensure the long-term success of your venture.

So, risk assessment acts as your trusted compass, whether you’re exploring the jungle or leading a business. It equips you to anticipate challenges, adapt to changing conditions, and make informed choices that pave the way for a prosperous and secure future.

Writing a risk assessment involves a systematic approach to identifying and evaluating potential risks in a specific context. While the specific format may vary depending on the industry or organization, here are some general steps to guide you in writing a risk assessment:

Remember, risk assessment should be tailored to your specific context, and it’s always beneficial to seek input from relevant experts or stakeholders to ensure a comprehensive and accurate assessment.

These questions can help assess legal risks in a business environment, covering areas such as regulatory compliance, labor laws, contracts, intellectual property, data privacy, consumer protection, anti-corruption, international operations, litigation, and tax compliance. Conducting a thorough legal risk assessment based on these questions can help identify areas of legal vulnerability and guide the development of appropriate risk management strategies.

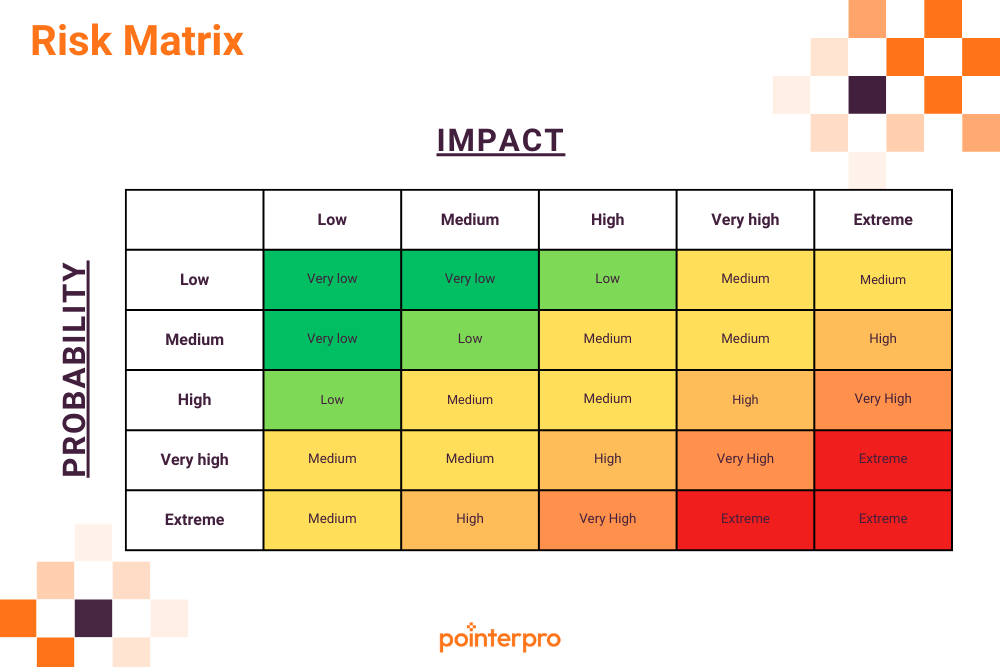

The 5×5 risk matrix, also known as the 5×5 risk assessment matrix, is a commonly used tool in risk management to assess and prioritize risks based on their likelihood and impact. It is called a 5×5 matrix because it consists of a grid with five levels of likelihood and five levels of impact, creating a matrix with 25 cells.

The matrix typically ranges from low to high on both axes, with likelihood (probability) represented on the horizontal axis and impact (consequence) represented on the vertical axis. Each cell in the matrix represents a combination of a specific likelihood level and a specific impact level, and it is associated with a corresponding risk rating or risk level.

The risk ratings or levels can vary depending on the organization’s preference. Still, a common approach is to assign a numerical or color-coded scale to each cell, ranging from low risk (e.g., green) to high risk (e.g., red). This allows for a visual representation of the risks and helps prioritize them based on their overall risk rating.

By plotting identified risks on the 5×5 risk matrix, organizations can better understand the relative importance and urgency of each risk. This helps determine the appropriate risk response strategies, resource allocation, and risk mitigation efforts. Risks falling into the high likelihood and high impact zone (typically the top-right area of the matrix) require immediate attention and more robust risk mitigation measures, while risks in the low likelihood and low impact zone (typically the bottom-left area) may be deemed acceptable or manageable with minimal intervention.

The 5×5 risk matrix provides a structured and visual approach to prioritising risks, aiding organizations in making informed decisions and effectively allocating resources to manage and mitigate risks systematically.

"We use Pointerpro for all types of surveys and assessments across our global business, and employees love its ease of use and flexible reporting."

Director at Alere

"I give the new report builder 5 stars for its easy of use. Anyone without coding experience can start creating automated personalized reports quickly."

CFO & COO at Egg Science

"You guys have done a great job making this as easy to use as possible and still robust in functionality."

Account Director at Reed Talent Solutions

“It’s a great advantage to have formulas and the possibility for a really thorough analysis. There are hundreds of formulas, but the customer only sees the easy-to-read report. If you’re looking for something like that, it’s really nice to work with Pointerpro.”

Country Manager Netherlands at Better Minds at Work

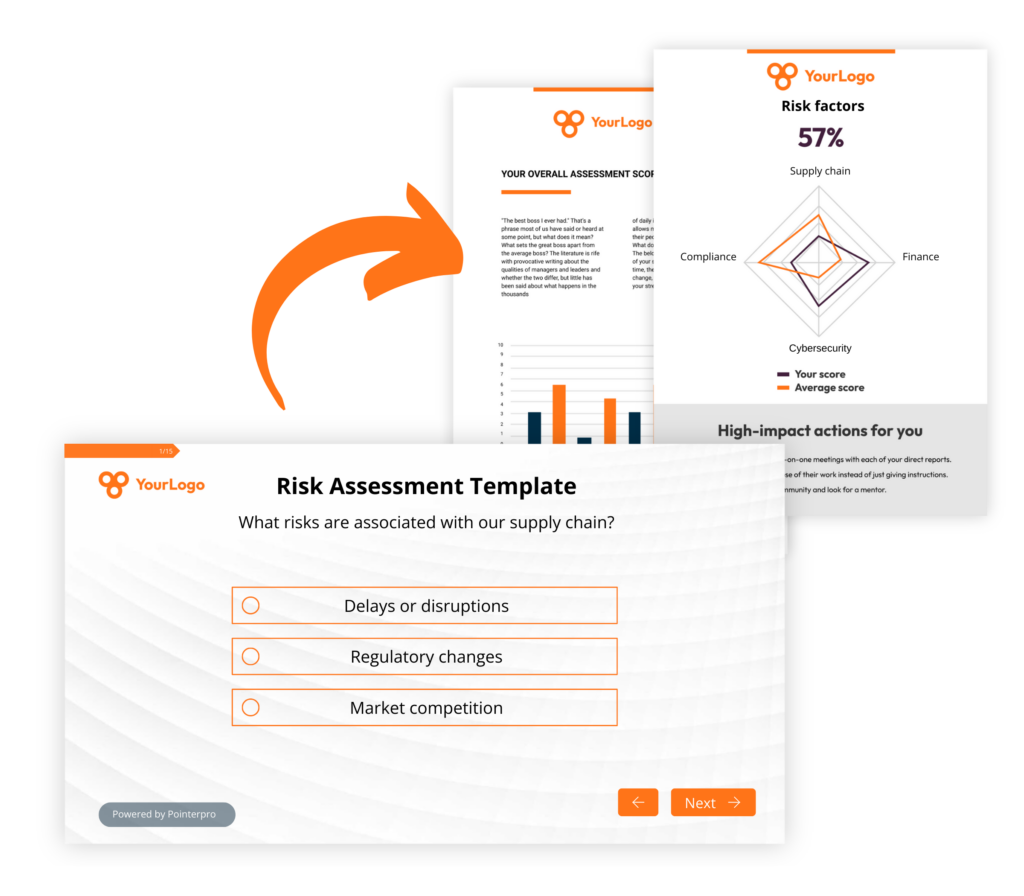

Example templates serve as a practical starting point to understand common risk categories, scoring methods, and reporting formats. You can adapt the structure and terminology to fit your organization’s unique risks and workflows, creating a customized risk assessment that suits your needs.

When using example templates, focus on aligning the risk categories and evaluation criteria with your industry context. Ensure that the impact and likelihood scales reflect your organization's risk tolerance, and add or remove sections to address specific operational or strategic risks relevant to your business.

Yes, example templates are valuable educational tools. They help teams familiarize themselves with the components of risk assessment, understand how to identify and rate risks, and practice filling out assessments before applying them in real scenarios.

No, example templates are illustrative tools designed to guide and inspire. They provide a snapshot of what a risk assessment might look like but should be integrated into a broader risk management framework that includes regular reviews, mitigation planning, and monitoring.

Review the template’s structure to see if it covers all critical risk areas for your business. Consider whether the scoring system is clear and practical. Also, assess if the example aligns with your reporting and compliance requirements. If gaps exist, you can customize or combine different templates to create a comprehensive assessment.