It’s no secret that COVID-19 hit businesses hard.

Sales nosedived. Sales teams threw projections out of the window. Companies cut down their workforce to stay afloat.

Like all industries, the fast-moving consumer goods (FMCG) sector grappled with the effects of the pandemic. Luckily some innovative companies, like one of our clients in Canada came up with innovative ways to deal with the crisis.

The groundbreaking solution of our client? A digital assessment! 😀

Doesn’t sound so groundbreaking, you say? Be assured. This FMCG company knows what it’s doing.

Their sales team got creative with Pointerpro. They designed an on-the-go survey their field team used to report on how stores displayed their brand’s products. Besides verbal responses, the team on the ground also took pictures of the displays and uploaded them on the survey platform. Why? To ensure products were displayed correctly and also to spot distribution gaps.

In this case study, we will dive into how they did it and what they got out of it. Pretty impressive stuff, as you’ll discover.

Want to discover more about offline survey building with Pointerpro? Have a quick read here.

The brain behind the operation?

The leading man for the undertaking was our client’s Distribution Strategy Manager, Jordan.

His core skills and experience lie in sales and marketing, where he has several years of experience. He started as a Category Development Manager and rose to the position of Sales and Distribution Strategy Manager.

As the Distribution Strategy Manager, he built, led, and institutionalized the content and standard by which the company expects the sales force to operate. Plus, he acted as the gatekeeper of the consolidation of data, to provide the organization with one source, one voice.

These duties came in handy when he was appointed Senior National Account Manager in January 2022.

Tackling the COVID market crunch

Jordan: “In our branch here in Canada, when COVID started, we were all locked out. We have an internal team in Toronto, our headquarters, but then we also have teams in Montreal, Calgary, Vancouver, and the whole prairies.

But with everybody being at home during the pandemic, we needed to make sure that we could leverage the full power of our Canadian organization to restore the market to pre-COVID standards and expand our reach.”

Who’s filling in the surveys and what’s your goal?

Jordan: “One of our retail marketing strengths, comes from our retail promotion people. In a normal world, they get to interact closely with consumers and hand out samples. But with COVID, we didn’t want our people (and our brand) in physical contact with multiple people.”

“Instead of laying off staff like most companies, we wanted to keep our workers active in their jobs during this challenging time. It was decided they could take on the task of going to premises all over Canada to assess how our products were displayed and to complete surveys for us.

That was our objective.

We categorize stores into on-premise and off-premise. On-premises are outlets where people buy and consume food on the premises, e,g. bars, nightclubs, and restaurants. Off-premises are places customers buy our product and consume it outside the premise, e.g. grocery stores and convenience stores.

Our survey focused on off-premise stores.”

Pointerpro to the Rescue

Jordan: “Pointerpro came in on the off-premise part. We wanted to retain our market share and brand image in-store. We had to prioritize our customers and our KPIs, focusing on off-premise, specifically in a large format.

We noticed a shift in our grocery stores and our big-box stores, not convenience or gas stores. Normally, we sell mostly in convenience stores and gas stations. Those places where people are on their way to work or somewhere.

During the early onset of COVID, everybody was locked inside, but they still had to do their work. Hence, people were going to stores to buy larger pack sizes of our product and return home. We saw a huge shift in our sales as they moved from small format to large format. Therefore, we knew we had to see what was happening in these stores to make sure we kept our brand’s image standards because people were now shopping there in large numbers.

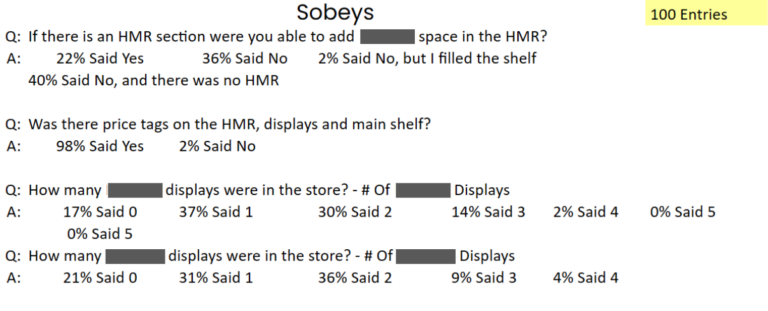

We looked at Walmart, Loblaws, and Sobeys. Each of these customers had a different focus.

In Walmart, it was all about secondary placements. For Loblaws, having multiple displays within the store was about the front-end coolers. When you’re at the cash register, there are coolers there, and we wanted to know if we had a placement there. At Sobeys, the main priority was the home meal replacement. When you have a grocery store that has hot and ready food, we want to know if they also have a beverage section there.

That’s where Pointerpro came into play.

We have our field-based teams out there and they’re going into stores. Instead of asking them to type in the region of the country they were in, we gave them a Custom Receiver (CR) number. Once they entered it, it generated all the store details. We did it this way to take out any chance of human error. Somebody could type info one way and another person can type it another way. Hence, the data won’t be clean, because now you have to filter for all those different entries.“

"But with Pointerpro, we were able to make data very specific and clean. You can’t mess it up because of human error."

“Using the CR number for entries allowed us to go to the back end of the survey campaign and pull out the address of a store. We now have store-level detail for all these stores that we have people going into.

Some of the most common questions that we put into the survey were:

- Does our brand have a placement at the front checkout?

- Is there a display set up in the electronics area?

- How many displays does our brand have in the store?

- How many of our main competitor displays are there in the store?

- Does our brand have the proper amount of facings in the HMR section?

There were multiple other questions, but these are the most common ones throughout. Here are some snippets of questions we’ve made with the tool.”

Can you share percentage numbers of your performance since you started using the tool?

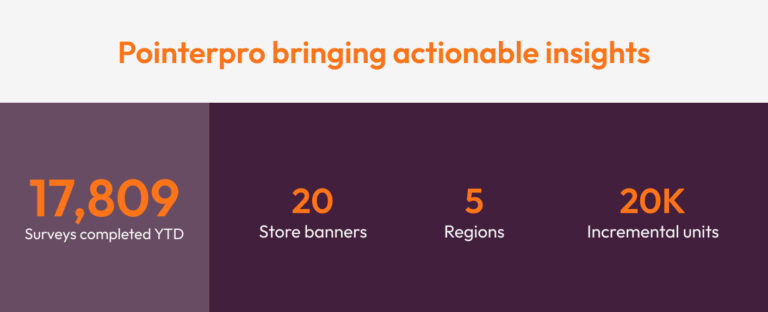

Jordan: “To give you some high-level detail, since we started this to date, we have:

- Completed 17,809 surveys on this one survey alone.

- Covered 20 store banners across five regions in the country.

- Generated an incremental 20,000 units in sales.

“We saw 20,000 incremental sales using actionable insights we got from the survey results. We are on track to do a 19% YoY increase for our business.”

“We would have one of our analysts go into Pointerpro and they would pull the data. Our analysts like to pull raw data and put it together themselves. What they could do from there was to buy banners and add the questions.

For example, we asked about what the promotional pricing is and if our distribution vendor merchandised the store. As a result, we got to know the pricing out there because sometimes pricing can vary by the banner. This information enabled national account managers to compare data with actual sales.

The survey allowed us to pick up trends of what was going on in-store.

Our field teams tell us which store sections need to be filled with our products. Armed with that info, our sales managers go in and put the placement in there. So having all eyes on the market and seeing what’s going on, we can now go in and fill in those gaps.”

Will you keep using the tool even after COVID? How else have you used the software besides this particular survey?

Jordan: “We may not use this exact survey over and over, but we are running a few other surveys.

Right now, the field team is running pricing and distribution surveys.

Our company doesn’t do direct store delivery. We hired a distributor to go into the stores and fill the shelves. Thus, if we pay a blanket price for an in-store marketing program, but we don’t get full execution, we never know its true value. Thankfully, the surveys reveal such issues. For example, we can know if we got one hundred percent execution, but we didn’t get the full sales lift. This program would not be worth it for us to do again next year with this account.

Our distribution manager, who’s an internal employee, would then take this information, seeing how we have it broken down by region. All of our distributors only cover a certain region and they don’t overlap each other. Now, our distribution manager can go in, look at the Ontario region, and see what’s going on. Afterward, the manager can take the insights to the distributor to address the store’s problems.

If it’s something connected with pricing, our analyst would do an analysis and see:

- Do we have the correct pricing strategy?

- Is there a possibility that we should invest in a promotion?

In some cases, we had an issue where a store banner said that they were having a lot of out-of-stock issues. We used this timely information to address the issue promptly.

It was a common issue at the time for a lot of FMCG brands to be out of stock. There were packaging material shortages all across Canada. You would walk into stores and find shelves empty because of the packaging supply challenges.

Therefore, if you’re not out there seeing what’s happening, all you see are numbers with no insights behind them. You can’t have an action plan.”

“But Pointerpro allowed us to have eyes on the ground. And then we had our internal data from our sales team, and we put two and two together and saw what's actually happening.”

“Because FMCG sells quickly, having no inventory in-store is a serious problem. The sooner you get an out-of-stock message, the faster you can fill up the placements. Pointerpro allowed the client to move quickly and replenish placements with their products.”

How did you find Pointerpro?

Jordan: “I believe I Googled survey systems or survey dynamics. I found Pointerpro and the website showed me the different features and what you could do with the software.”

What made working with Pointerpro special? Which features did you find useful?

A prompt, versatile software.

Jordan: “It’s crazy because I always get emails from the field marketing team. Sometimes they tell me they put a question wrong or want to change something. I can instantly go in there, change it, and boom, it’s out there in seconds.”

“We enjoy the versatility we have at our fingertips. Also, we have distributors that use a different platform. You’d have to go in and pull data from it and then compile it together. But this is something that everybody has access to because they can just access it on their phone.”

A simple, centralized data center.

Jordan: “If you had somebody who isn’t an analyst, they can pull the data out of Pointerpro and be able to easily digest it. But we also have analysts here who prefer the raw data and the ability to make it look different.”

“That’s a personal choice by our analysts.”

A data sample of the survey pulled from Pointerpro (Entries by Region)

A data sample of the survey pulled from Pointerpro (Entries by Banner)

“Data presentation is a vital aspect of any survey tool.

The best tools present data to users in a simple, clean, and visual way anyone can understand. Plus, they are flexible enough to allow advanced users to gain access to raw data and present it their way. It’s their data, after all, so they should be able to package it however they prefer. That’s what our FMCG client did in this case.”

A handy upload picture feature.

Jordan: “One thing I found helpful is the fact that you can add a picture. Our field staff can take a picture and link it at the end of the survey. We have another tool we use to upload pictures. It’s limited because you can only submit one picture. But with Pointerpro, our field team members can add three pictures.”

“You can click on the picture to understand submissions better.”

"The picture upload feature had great added value because we now have a portfolio of pictures for reference when we need to do something."

“We often talk to customers about what their stores could look like. Now, we show them pictures of real outlets that are already out there using pictures from the survey. It’s not a mockup or a 3D diagram. It’s an actual thing.”

“FMCG brands must see how distributors display their products in stores. An impressive shelf presence grabs shoppers’ attention, promotes brand loyalty, and increases brand awareness. That’s why our client found the photo upload feature invaluable. It allowed them to have eyes on the market at a time when it was challenging to move around.”

A dynamic, customizable platform.

Jordan: “Another big thing that I want to highlight is that when the ground team clicks on an account, they see specific questions tailored to those banners. Within the whole survey, there are 60 questions, but somebody could only need three relevant questions and they’re not flipping through all 60. They only see those three based on what accounts they’re in.”

A delightful onboarding experience?

Jordan: “When I called Mark, I asked him all the questions about what is possible with the tool. And he said, look, if you also can’t figure out how to do something, you can send us the project, and we can have our team build it for you and put it into your account for everybody to use.

So that was the big sell for me right there.

He also gave me a free trial to go in and see everything to make sure it checked all the boxes. I see our company’s Canada branch using Pointerpro for the foreseeable future because of how dynamic it is.”

Long story short.

Every tool has typical uses.

Most brands stop at those standard functions.

But our innovative FMCG client took things a step further. They found an uncommon way to use surveys to solve a pressing problem at an unprecedented time. The company realized its brand and mission are unique. Therefore, it got creative, tried something new, and reaped handsome rewards.

The biggest takeaway?

Creative use of tools in your marketing and sales technology stack can produce remarkable results.

Be creative. Experiment with Pointerpro and other tools. You might find yourself pleasantly surprised.