Meet our customer, Tom Anderson!

He’s a New York Times best-selling author who previously worked in investment banking and wealth management at top firms like Morgan Stanley and Merrill Lynch.

Tom’s company, Anasova, is on a mission to deliver free financial plans to everyone. A prime example of the birth of democratized financial services.

In a video interview with our CEO Stefan Debois, Tom talked about how Anasova rapidly scaled its business with minimal investments.

What did he learn along the way?

Check out Tom’s 7 helpful tips to fast-track your lead generation funnel in any industry.

1. Tap into new markets

Anasova started with a direct-to-consumer model

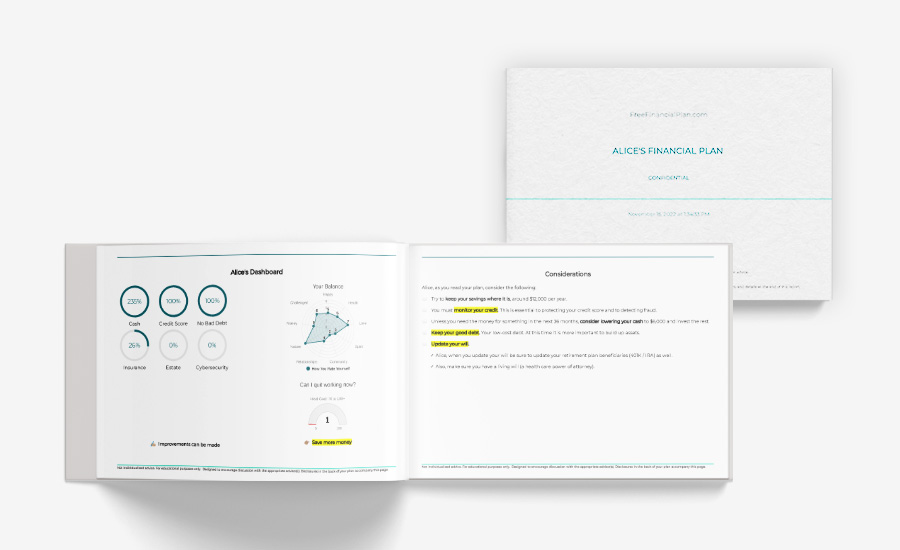

Consumers get fast and free financial plans through FreeFinancialPlan.com. The online self-assessment and reports are entirely automated with Pointerpro reporting software, providing 24/7 access to personalized guidance.

We thought that the plan would be the answer and we’re finding that it’s not. When people get the plan, they want to have a conversation.

It’s efficient because with the plan, we already have access to data that usually would take multiple meetings to find out: ‘Are you married? Do you have kids? What are your assets?’

After each assessment we can just get to business and serve a much broader market.

And then successfully added B2B solutions

Consider white labeling and reselling your assessments and reports as lead generation tools to other companies, which potentially have a much broader audience.

Once we built the site, a financial services company tapped us on the shoulder: ‘Hey, can we white label your solution?’ So we said: ‘Absolutely!’

What we have since discovered is that there’s a big opportunity in delivering these as white label solutions to companies and advisors as an engagement tool on the front-end of their website.

2. Identify underserved audiences

These free financial plans target consumers that are typically not served by the traditional financial service players.

Tom democratized financial planning services: giving more people access by using digital tools.

If you have more than $2 million, everybody in the financial services industry wants to work with you.

But what if you have a net worth of $50,000 to $2 million? Mostly invested in your home, retirement plan, checking and savings accounts, and some alternative investments. Limited assets to move to an advisor.

Advisors typically don’t target that market because it’s not profitable for them when it takes so much time to gather the information and data. We gather that very quickly for them.

Yet that market wants advice. They have kids, they want to live their best life today and stay on track for the future. There’s a tremendous need: in the US about 68 million households that are not really being served. They are not getting what they want through free index funds, robo advisors, asset allocation funds or through the adviser channel.

3. Rent the right technology infrastructure

I don’t want to spend time building your automated assessment and reporting tool myself. That would take the rest of my life trying to perfect the logic and user experience.

So, don’t build your software from scratch. Of course, every system will have its constraints, but Tom uses these to his advantage. He says it makes him more disciplined with how to ask the questions in the financial plan assessment.

4. Release something, get feedback

Don’t try to get your product or service to a perfect state. Try to get it to a good enough state to attract customers. Then release it, get feedback and refine it.

What you think people want, is going to end up being different! Monitor closely what your users have to say.

That feedback is also how Anasova went from solely a D2C model with FreeFinancialPlan.com to also offering B2B SaaS lead generation tools and white label solutions.

5. Don’t count on your ‘Contact us’ button

There’s a tremendous amount of money spent on advertising, along the lines of: “Go to my website, then hit the ‘Contact me’ button.”

We think that’s kind of a weird process. In our case, financial services advertising is very expensive, and only moderately effective at best.

When promoting a mortgage product, credit card or access to a financial planner, what we’ve found is that people don’t want to talk to people or fill out an application. They don’t wake up on a Saturday morning and say: ‘Today’s the day I’m going to refinance my mortgage.’

6. Build engagement on the front-end of your website

Instead, Tom draws people in with a financial plan: fast, free and anonymous.

People like engaging quizzes and getting feedback. Once people have the plan, we present different solutions to them, to which they are much more receptive at that point in time.

We get a 30% lead conversion rate. Much higher than display or search, and much more efficient than a salesperson.

7. Put your best things out there to build trust and get more business

As a proponent of the democratization of professional services, Tom advises consultants and advisors to put their best things out there for free. That way, people will gain trust and confidence in the rest of the things that you say.

What I’m consistently finding when working with your Pointerpro tool is the more that you give away great free advice, the more people want to talk to you. It’s the beginning of the story and not the end.

There’s plenty of opportunities to drive a good relationship, but it is hard to establish that front-end credibility. You get more business that way.

Thanks for sharing your experience and tips with us, Tom!

Visit FreeFinancialPlan.com to build your personalized financial plan for free in a matter of minutes.

Watch the full video below.