When you first start working, you realize that earning a profit is more important than making money. If this sounds confusing to you, you better read this article carefully. The approach you use to compute your consulting rate should not be superficial, such as the salary you want divided by the number of hours worked each year. The math is correct, but the thinking behind it is all wrong.

To convert the money you earn to a profit, your payment should be based on balancing the life you desire with your worth, target client, and the larger competitive market.

You may charge for your services in two ways. The first option is to bill clients on an hourly basis. You calculate your hourly rate and charge the client based on how long you work on the project. The second approach to charge clients is by a fixed fee, which is common in the form of a package deal, such as completing a specific service or supplying them with a product.

Now, let’s look at how you should compute your consulting rate properly.

1. Look at the industry standard

Setting a reasonable price for services is more challenging than just adding a markup to a physical product. The main reason is that calculating the value of your time, counsel, staff skills, and experience is more subjective.

So, you’ll need to do some investigative work to find out what the industry’s reasonable price is. Also, you need to discover what other service providers or your competitors are pricing for similar services with a similar client.

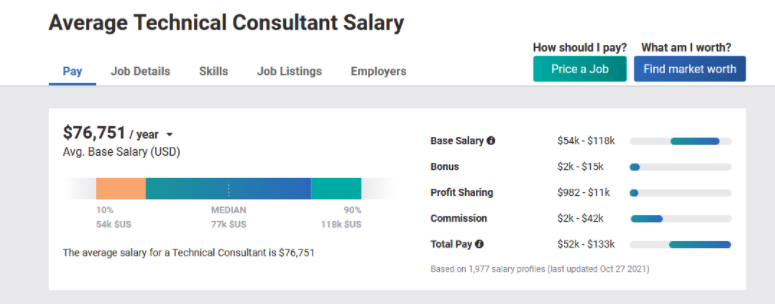

For planning reasons, you may get rough estimates from trade groups in your industry, people you know who have recently done projects similar to the ones you want to provide, or an online search. Payscale, for example, is an online tool that may give you a detailed report on salary in your industry.

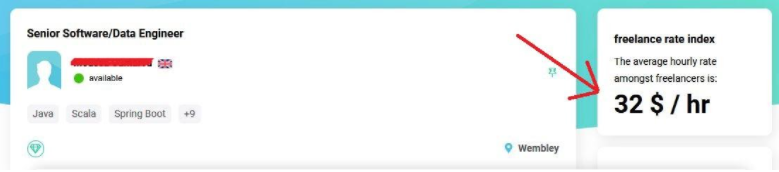

Or, you may go to a freelancing website like freelancermap and put in your nation and a keyword to discover the industry standard in your country.

That will assist you in determining an hourly rate that matches what your potential clients are willing to pay.

2. Determine your value to the business

Sometimes, pricing is dependent on how much money the customer gets from what you accomplish, not on how much time or effort you put into the project.

In other words, you charge a percentage of the new business profit as your fee if the job you conduct can bring in a significant quantity of new business. For instance, imagine you are an eCommerce consultant. You are providing support to eCommerce sites.

The project you manage for your customer may result in a $100K increase in new sales. You charge 20% of that ($20,000) as your consulting rate.

However, calculating that value-based pricing is a little challenging. You must be aware of the data required to obtain a complete picture of the project, including client goals, project roadmap, the monetary worth of what they’re paying you to develop, and performance metrics. You should also take into account any additional expenses related to other professionals if project submission would require assistance with properly calculating the labor cost percentage.

On the other hand, your client’s honesty is critical. That’s why it’s a good idea to work with your client for several hours or days to get the exact data and value the price.

3. Take into account your experience

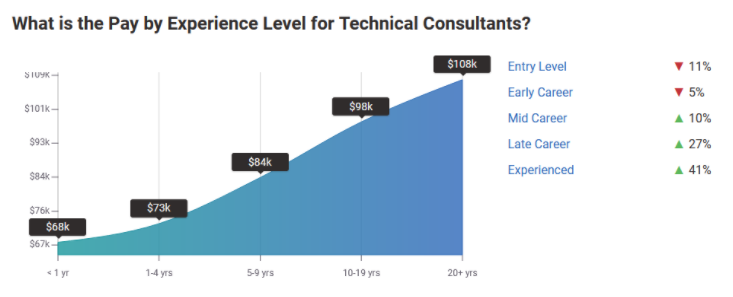

Naturally, the more experience you have, the higher your hourly rate will be. Also, since you’ve been so good at your work, you should reward yourself by charging more. Some people believe you should charge $5 per year of experience, while others believe you should charge anything from $1 to $100 or even $1000.

Let’s give you an example with a fixed value. If you charge $10 per year of experience, your experience is worth an additional $40 after four years. So, if you were charging $15/hour, you should raise your consulting rate to $55/hour. You may also raise your rate by a percentage, as shown in the image.

Of course, the cost of a year of expertise might vary based on your industry and other considerations, such as your professional equipment and the value that you provide to your client.

4. Consider project length

If you charge on a project basis rather than an hourly basis, you must evaluate the time it will take you to complete a project and its value to your client. For example, if you are a web designer and charge $500 for a project that takes 40 hours, your hourly rate is just $12, which is too low for your industry and the worth of your work.

As a result, you’ll need to estimate how many productive hours you’ll be able to work every day for a project. Consider the multi-tasking that must be adhered to to get successful outcomes. You can also incorporate time tracking into your workflow to enhance your project estimation accuracy.

5. Calculate your monthly expenditure

You need to earn a profit to grow and thrive. Your profit is the net income after deducting all expenses. Your consulting hourly rate should cover all of your monthly expenses while still saving as well.

So, depending on the type of consultant you are, you must examine your spending, such as taxes, rent, internet, office equipment, service subscriptions, and so on. You can figure out your quarterly tax estimation using Keeper’s tool. Keep in mind that you don’t need to make quarterly tax payments unless you expect to be taxed more than $1,000 in a year.

Then, make a list of all the expenses you spend as a consultant and include them in your calculating process.

6. Keep in mind how busy you are

Don’t be the busy fool who works long hours without keeping track of billable time. You should be aware that any time spent working on tasks directly linked to your client’s project is considered billable time, and accurately calculating billable hours is essential.

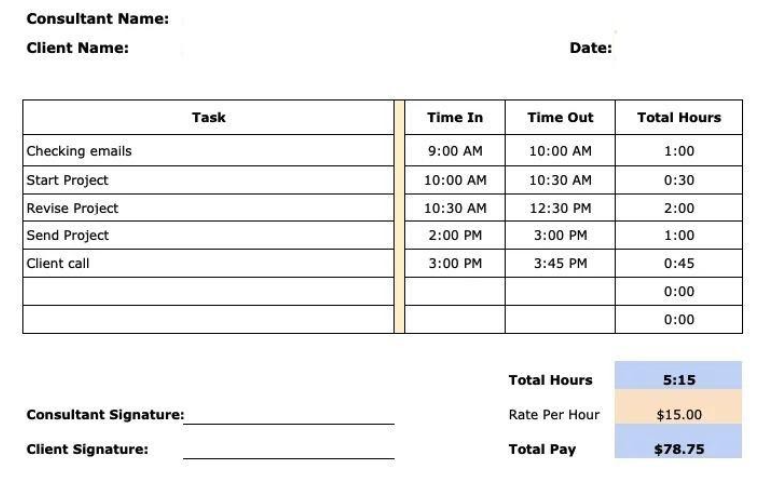

So, you must estimate the additional management tasks required to run a freelancing business, such as project planning, research, meeting attendance, reading and replying to work emails, and so on. Consider, for example, this consulting rates timesheet template, where the consultant includes the additional daily tasks he performs for the project.

You can calculate these billable hours based on the payment period, weekly, daily, or monthly.

7. Set a baseline minimum rate

You didn’t start a business to be underpaid or to be a slave to it. You deserve to be paid fairly for a job well done, and as long as you price your services correctly, taking expenditures, profits, and quality of life into account, you’ll be able to do so.

In other words, you must know your minimum hourly rate.

Here’s how to estimate what your minimum consulting rate should be:

- Figure out how much money you want to make. Let’s suppose you desire a yearly salary of $100,000 and full-time 40-hour workweeks.

- Calculate your expenses and add them all together to your desired cost. Assume your overhead costs are $20,000 per year. So: 100,000+20,000 = $120,000

- Then, calculate the overall cost of doing business or the profit margin and add it to the sum. The typical profit margin for client services is 10% to 20%. Let’s go with 20%. 120,000 x 20% = $24,000. Then 120,000 + 24,000 = $144,000.

- Next, find out how many billable hours you worked, such as responding to clients, administrative work, business travel days and so on. Also, since you won’t be working 40 hours a week for the entire year, you’ll need to account for breaks, sick days, and holidays. Let’s take an example. Assume you take:

|

Days |

|

|

Weekends |

104 |

|

Vacation days |

14 |

|

Sick days |

8 |

|

Business travel days |

5 |

| Total |

131 (1048 hours) |

We must deduct these holidays. So, 365 – 131 = 234 days.

Let’s say you work 8 hours: 234 x 8 = 1872 hours

So, we just work and bill 1872 hours per year.

Now, you may compute your minimum hourly rate: The overall expense of conducting business is $144,000.

The total number of billable hours you will work in one year is 1872.

Your minimum hourly rate is 144,00/1872 = $76/hour.

As you can see, the minimum hourly rate required to earn $100,000 per year is $78/hour.

In closing

More and more of us are diving into the world of self-employment. Instead of relying just on the number of hours, it’s critical to understand how to assess your experience, dependability, and quickness.

Your payment should be based on the lifestyle you want to create for yourself. That requires a well estimating of your consulting rate to prevent financial problems. So, to compute an hourly rate that covers your costs while also supporting the quality of life that you desire, ask yourself these questions:

- What is the industry average rate?

- Will I provide value to the company?

- What is the value of my experience?

- How long will it take me to complete a project?

- How many billable hours do I put in each week?

- How much money do I spend each month on work and life?

As you can see, all of this should be taken into account when determining the price for your business. That may appear to be a substantial sum, but all companies, agencies, entrepreneurs, and consultants charge clients this way. Why shouldn’t you?

To conclude, here is a two-minute video of Pointerpro’s Marketing Director with five tips to calculate your consultancy rate.