Competitor assessment template

Taking on a key competitor starts with asking the right questions about them.

Then it’s all about applying your assessment logic as a marketing or business expert and pouring it into a clear report. But what if you could automate the process?

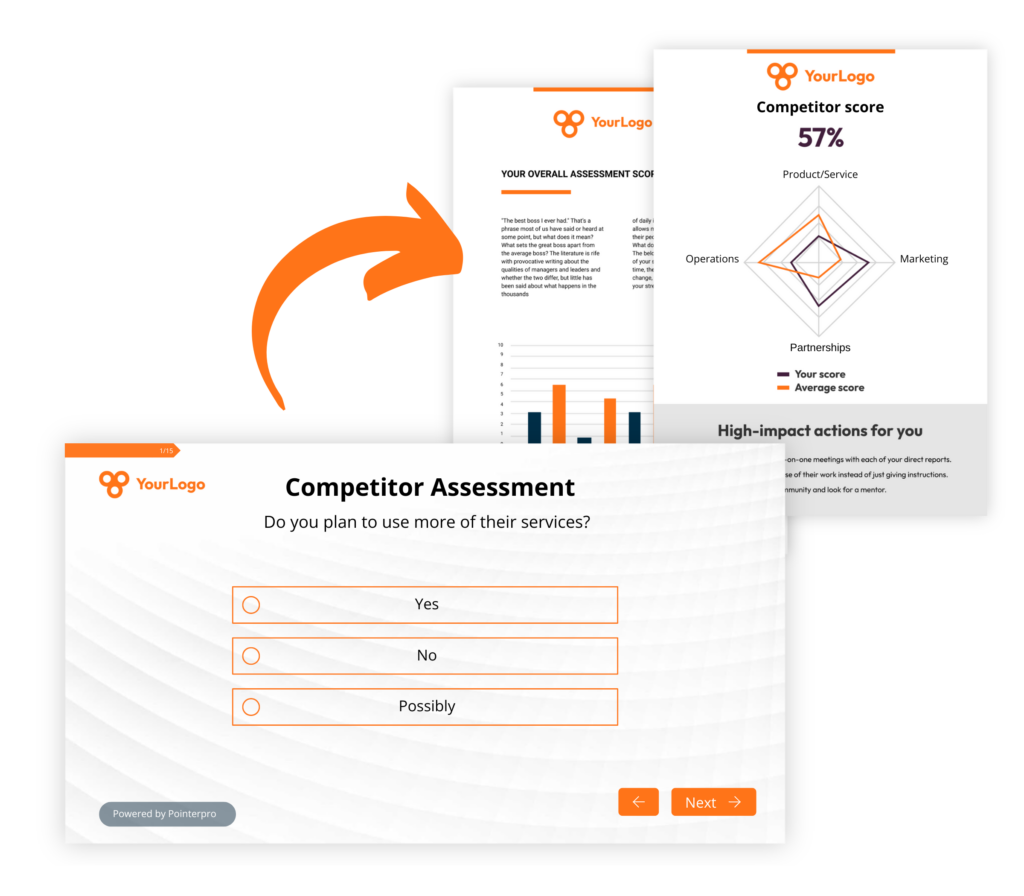

Pointerpro is the 2-in-1 software that combines assessment building with personalized PDF report generation.

What is a competitor assessment template? 5 key elements.

First off, let’s clarify one thing: When we say “competitor” assessment, we are talking about an analysis of one specific competitor. If you’re looking for more information about an industry or market-wide competitive analysis, check out the competitive assessment template page.

A competitor assessment will deepdive into into the nuts and bolts of one competitor. But that doesn’t mean you have to do all that work and spend all that time over and over again, whenever you’re zooming in on another competitor. What you need to do is pour your expertise as a marketer or business expert into a competitor assessment template, a smart questionnaire, if you will. Here are some key elements:

- Engaging question logic: Use dynamic question flow that tailors the questionnaire based on previous responses, ensuring relevance and engagement by skipping irrelevant sections and diving deeper into areas of concern. Incorporate behavioral and perceptual questions to probe into the competitor’s market actions and perceptions from customers, employees, and partners.

- Custom scoring: Develop a weighted scoring system where different questions have varying levels of importance based on their impact on the competitive landscape, allowing for a focus on critical areas like innovation or customer satisfaction. The custom scoring system should translate qualitative data into quantitative metrics, facilitating easy comparison of various competitor attributes.

- Comprehensive data collection: Design the questionnaire to include a mix of quantitative (e.g., multiple-choice, rating scales) and qualitative (e.g., open-ended) questions, ensuring a rich data set that allows for both comparison and deep insights. Another good tip is to incorporate benchmarking questions to measure the competitor's performance against industry standards or your own company’s metrics.

- Competitive strengths and weaknesses analysis: Focus questions on uncovering the competitor’s strengths, weaknesses, opportunities, and vulnarabilities. There are several competitor assessment frameworks to inspire yourself. Include queries that explore the competitor's strategic intent, such as goals for market expansion, innovation, or cost leadership, to reveal potential future moves.

- Formula-based insights: Implement a formula-based analysis approach that automatically and objectively calculates scores and generates insights from the collected data, with visualizations like graphs and charts to enhance interpretation. Ideally - if your customer assessment tool gives you the ability - create custom reports tailored to different audiences, such as concise summaries for leadership and detailed analytical reports for deeper dives.

3 reasons to use Pointerpro as a competitor assessment tool

3 reasons to use Pointerpro as a competitor assessment tool

Interactive user experience

With the Questionnaire Builder, you get to create an engaging assessment. How? With numerous design and layout options, useful widgets, and countless question types.

Refined, score-based analysis

Our custom scoring engine helps you quantify and categorize diverse answers. The result? An objective and nuanced assessment of any competitor at hand.

Automated feedback in PDF

Thanks to your setup in the Report Builder, respondents instantly get a detailed PDF report: with personalized responses, useful information, and your brand design.

1.500+ marketers and consultants worldwide build assessments with Pointerpro

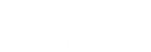

The 4C competitor analysis template

Whenever you build questionnaires for a competitor analysis, the trick is to come up with questions that probe as broadly as possible. When you analyze a competitor you want to know everything about them, don’t you? Not just a few aspects.

A useful rule of thumb to make sure you’re covering the necessary ground is to keep in mind 4 Cs that paint your competitors picture: Context, company, customers, and collaborators.

Depending on which of the Cs you zoom in on, it’s highly likely – if not, recommended – you create separate assessments from which to aggregate the insights (into an aggregate report), or not.

Context: Understanding the environment

Context refers to the external environment in which the competitor operates. This includes the market conditions, industry trends, regulatory landscape, economic factors, and technological developments. When analyzing context, you should consider:

- Market trends: What are the prevailing trends in the industry? Is the market growing, shrinking, or in transition?

- Regulatory environment: Are there any laws, regulations, or policies that significantly impact the competitor’s business? How do they adapt to these changes?

- Economic factors: How do macroeconomic factors like inflation, interest rates, or consumer spending influence the competitor?

- Technological developments: Is the competitor leveraging new technologies? How do they adapt to or lead technological changes in the industry?

Company: Internal characteristics and strategies

This C focuses on the competitor’s internal workings, including their business model, organizational structure, financial health, and strategic objectives. Key areas to probe include:

- Business model: What is the competitor’s business model? How do they generate revenue and profits?

- Organizational structure: What is the company’s structure? How does it affect their agility and decision-making?

- Financial performance: What is the financial health of the competitor? What do their revenue, profit margins, and cash flow indicate?

- Strategic goals: What are the company’s short-term and long-term goals? How do they plan to achieve these objectives?

- Core competencies: What are the company’s key strengths? How do they differentiate themselves from others in the market?

Customers: Understanding the target audience

This is an exploration of the competitor’s customer base, including their needs, preferences, behaviors, and demographics. By understanding their customers, you gain insights into how the competitor positions themselves and what drives their success. Consider examining:

- Customer segments: Who are the competitor’s primary customers? What demographic, geographic, or psychographic characteristics define them?

- Customer needs and preferences: What are the key needs and desires of these customers? How well does the competitor meet them?

- Customer loyalty and satisfaction: How loyal are the competitor’s customers? What is their level of satisfaction with the competitor’s products or services?

- Customer acquisition and retention strategies: How does the competitor attract and retain customers? What marketing, sales, and customer service strategies do they use?

Collaborators: Partners, suppliers, and alliances

This one’s often overlooked, and can therefore be very revealing. It refers to the network of external entities that support the competitor, including suppliers, partners, distributors, and strategic alliances. Understanding these relationships is crucial for assessing the competitor’s ecosystem and operational efficiency. Points to explore include:

- Key suppliers: Who are the competitor’s main suppliers? How dependent are they on these suppliers, and what is the nature of these relationships?

- Strategic partnerships: The goal is to gain a comprehensive view of the market and identify opportunities and threats across the entire competitive environment. This analysis helps in strategic planning and understanding market dynamics.

- Distribution channels: What distribution channels does the competitor use? How effective are these channels in reaching their target customers?

- Joint ventures and alliances: Has the competitor entered into any joint ventures or strategic alliances? What benefits do these relationships bring?

Competitor analysis: Who could I approach with my questionnaires?

To effectively gather information about the “4 Cs” through questionnaires, it’s useful target individuals or groups who are knowledgeable and likely to respond. Below’s a short overview of who you could consider approaching:

Important disclaimer: Ensure that your information-gathering efforts are both legal and ethical.

- Industry analysts and experts: These individuals often have a broad understanding of the market, industry trends, regulatory changes, and technological developments. They can provide insights into the broader context in which your competitor operates. Approaching industry analysts, consultants, or academic experts with questionnaires can help you gather information on market dynamics, economic factors, and regulatory impacts.

- Trade associations and industry bodies: Representatives from these organizations can offer valuable insights into industry trends, common challenges, and the regulatory environment. They are often willing to participate in surveys or questionnaires that contribute to industry knowledge.

- Former employees: Ex-employees of the competitor are often a rich source of information about internal workings, including business strategies, organizational culture, and financial health. They may be more open to sharing insights, especially if they’ve moved on to different industries or roles.

- Business partners: Partners who have worked with the competitor, such as consultants, vendors, or contractors, can provide insights into the company’s operations, strategic goals, and business model. They are often willing to participate in questionnaires if they believe it can benefit their own business understanding.

- Current and former customers: Customers who currently use or have used the competitor's products or services are invaluable for understanding their needs, satisfaction levels, and loyalty. You can approach them through surveys, social media, or customer feedback platforms. Offering incentives (like discounts or small gifts) can increase response rates.

- Distribution partners and resellers: These entities interact closely with your competitor and understand their distribution strategies, channel effectiveness, and market reach. They are likely to participate in questionnaires that help them improve their own competitive positioning.

- Suppliers and vendors: Suppliers who provide goods or services to your competitor can offer insights into their supply chain practices, purchasing power, and operational efficiency. These partners might be willing to share information through questionnaires, especially if they believe it could strengthen their business relationship with you.

- Joint venture partners and strategic allies: Partners involved in joint ventures or strategic alliances with your competitor can provide in-depth insights into collaborative efforts, resource sharing, and strategic goals. Approaching them with well-structured questionnaires can yield valuable information.

Some ethical guidelines on gathering insights on competitors

Compliance with data protection laws

- Understand applicable laws: Familiarize yourself with data protection regulations such as the GDPR (General Data Protection Regulation) in Europe, CCPA (California Consumer Privacy Act) in California, and other relevant laws in your jurisdiction. These laws govern how personal data can be collected, stored, and used.

- Obtain informed consent: Always obtain explicit consent from individuals before collecting any personal data. Clearly explain what information you’re collecting, how it will be used, and how it will be stored.

- Anonymize data: Where possible, anonymize the data you collect to protect the identity of respondents. This reduces the risk of violating privacy laws and ensures compliance with data protection regulations.

Respecting non-disclosure agreements (NDAs)

- Avoid confidential information: Be cautious when asking former employees or business partners for information. Ensure that they do not disclose any proprietary or confidential information that they are legally bound to protect under NDAs.

- Include open-ended questions: Frame your questions in a way that encourages respondents to share their personal experiences or general insights without violating any NDAs or proprietary agreements.

Ethical considerations

- Be transparent: Clearly communicate the purpose of your questionnaire and how the information will be used. Transparency builds trust and ensures that respondents understand the context of your research.

- Avoid misrepresentation: Do not misrepresent yourself or the purpose of the questionnaire. Honesty is crucial to maintaining ethical standards and avoiding potential legal repercussions.

- Respect confidentiality: If a respondent shares sensitive information, respect their confidentiality and avoid sharing it without their permission. This is not only ethical but also builds credibility and trust.

Respecting non-disclosure agreements (NDAs)

- Avoid confidential information: Be cautious when asking former employees or business partners for information. Ensure that they do not disclose any proprietary or confidential information that they are legally bound to protect under NDAs.

- Include open-ended questions: Frame your questions in a way that encourages respondents to share their personal experiences or general insights without violating any NDAs or proprietary agreements.

Legal counsel, compliance and ethical use

- Seek legal advice: Before conducting competitor analysis, especially if you plan to gather information from potentially sensitive sources, consult with legal counsel. They can provide specific guidance on how to stay within the bounds of the law and avoid potential risks.

- Avoid anti-competitive practices: Be aware of antitrust laws that prevent anti-competitive practices. Gathering competitive intelligence should not involve collusion, price-fixing, or other illegal practices that could harm competition.

- Use information responsibly: Ensure that the insights gained from your questionnaires are used ethically and responsibly within your organization. Avoid using the information in ways that could harm the competitor unfairly or lead to unethical business practices.

30 competitor assessment example questions

Let’s say, you’ve chosen to approach customers and ex-customers of your competitor.

Here are 30 competitive assessment example questions you could ask divided into 3 categories:

- 10 competitive assessment example questions about B2C FMCG businesses

- 10 competitive assessment example questions about B2C service companies

- 10 competitive assessment example questions about B2B service companies

10 competitor assessment example questions about B2C FMCG businesses

- How would you rate the overall quality of [Competitor Name]’s products?

- What makes [Competitor Name]’s products stand out compared to other brands in the market?

- How does the pricing of [Competitor Name]’s products compare to similar products from other companies?

- How effective are [Competitor Name]’s advertising and promotions in influencing your purchasing decisions?

- What issues or challenges have you experienced with [Competitor Name]’s products or services?

- How would you describe the availability and convenience of purchasing [Competitor Name]’s products in your area?

- How well do [Competitor Name]’s products meet current trends, such as sustainability or health?

- How would you rate the packaging and presentation of [Competitor Name]’s products?

- How likely are you to continue buying products from [Competitor Name] in the future?

- What additional products or improvements would you like to see from [Competitor Name]?

These competitor assessment template questions focus on assessing the overall quality and distinctiveness of the products, as well as the effectiveness of pricing, advertising, and distribution. By exploring aspects such as product quality, packaging, and alignment with consumer trends, you gather insights into how well the company meets customer expectations compared to other brands.

It’s always useful to include both quantitative (rating scales) and qualitative (open-ended) questions. It ensures a deeper understanding of consumer perceptions and identifies potential areas for product or service enhancement.

10 competitor assessment example questions about B2C service companies

- How would you rate the overall quality of services provided by [Competitor Name]?

- What features or aspects of [Competitor Name]’s services do you find most valuable?

- How does the pricing of [Competitor Name]’s services compare to similar services from other companies?

- How effective is [Competitor Name]’s marketing in influencing your decision to use their services?

- What challenges or issues have you experienced with [Competitor Name]’s services?

- How would you rate the customer support provided by [Competitor Name]?

- How well do [Competitor Name]’s services meet your needs compared to larger or other service providers?

- What areas do you think [Competitor Name] could improve in their service offerings?

- How likely are you to continue using [Competitor Name]’s services in the future?

- What additional services or improvements would you like to see from [Competitor Name]?

These competitor assessment template questions to analyze B2C service companies center on evaluating service quality, customer support, and how well the services meet consumer needs. They aim to uncover the strengths and weaknesses of the service offerings, including pricing, effectiveness of marketing, and any issues experienced by customers.

10 competitor assessment example questions about B2B service companies

- How would you rate the overall quality of services provided by [Competitor Name] for businesses?

- What are the main strengths of [Competitor Name]’s services compared to other B2B service providers?

- How does the pricing of [Competitor Name]’s services compare to similar services from other B2B companies?

- How effective is [Competitor Name] at addressing the specific needs and challenges of your business?

- What issues or difficulties have you faced with [Competitor Name]’s services?

- How would you rate the professionalism and expertise of [Competitor Name]’s staff?

- How well do [Competitor Name]’s services integrate with your existing business processes?

- What areas do you think [Competitor Name] could improve to better serve businesses like yours?

- How likely are you to recommend [Competitor Name] to other businesses?

- What additional services or enhancements would you like to see from [Competitor Name]?

To analyze B2B service companies, these competitor assessment template questions focus on the quality of service delivery, pricing, and the ability to address specific business needs.

The questions explore the professionalism of staff, integration with existing business processes, and overall effectiveness in meeting business challenges. By using a mix of rating scales and qualitative questions, the assessment captures detailed feedback on service strengths and areas for improvement.

What Pointerpro clients are saying

7 competitor assessment frameworks for your inspiration

When assessing a single competitor, business and marketing experts already use several frameworks to analyze and understand whoever they’re analyzing. These frameworks help businesses to strategically position themselves in relation to the competitor. Here are 10 such frameworks:

- SWOT analysis: Strengths, Weaknesses, Opportunities, and Threats: SWOT is a classic tool for analyzing a competitor's internal strengths and weaknesses, as well as external opportunities and threats. This framework provides a clear overview of a competitor's strategic position.

- Porter’s five forces: This framework is all about industry structure: This framework assesses the competitive forces that influence the industry, but it can also be tailored to focus on how a single competitor is affected by these forces: the threat of new entrants, bargaining power of suppliers and customers, the threat of substitutes, and the intensity of competitive rivalry.

- Porter’s generic strategies: This framework analyzes a competitor’s strategy in terms of cost leadership, differentiation, or focus. Understanding which generic strategy a competitor employs helps to anticipate their actions and strategic moves.

- Value chain analysis: By analyzing a competitor's value chain, businesses can understand how they create value at each stage, from production to marketing. This helps in identifying strengths and weaknesses in the competitor's operations.

- VRIO framework: The VRIO framework assesses a competitor's resources and capabilities to determine if they provide a competitive advantage. The analysis focuses on whether resources are Valuable, Rare, Inimitable, and Organized.

- BCG matrix (competitor's product portfolio analysis): Originally used for internal analysis, the BCG matrix can be applied to assess a competitor's product portfolio based on market growth rate and relative market share, categorizing products as Stars, Question Marks, Cash Cows, or Dogs.

- PEST analysis: PEST (Political, Economic, Social, and Technological) analysis focuses on the macro-environmental factors affecting a competitor. This can help to anticipate external challenges and opportunities they may face.

Create your first competitor assessment today

You may also be interested in

Recommended reading

How Connections In Mind benefits the community interest through a digital mindset and a longitudinal assessment

The fact that communities benefit from diversity should not be news to anybody. One type of diversity you may not

Vlerick Business School digitalizes entrepreneurship development with Pointerpro [case study]

What do a top-tier international business school based in the capital of Europe and Pointerpro have in common? At the

Attain Global: How to do psychometric tests right and build a cutting-edge international business [case study]

In many countries worldwide, the pursuit of skillful and engaged employees is not so much a war on talent as